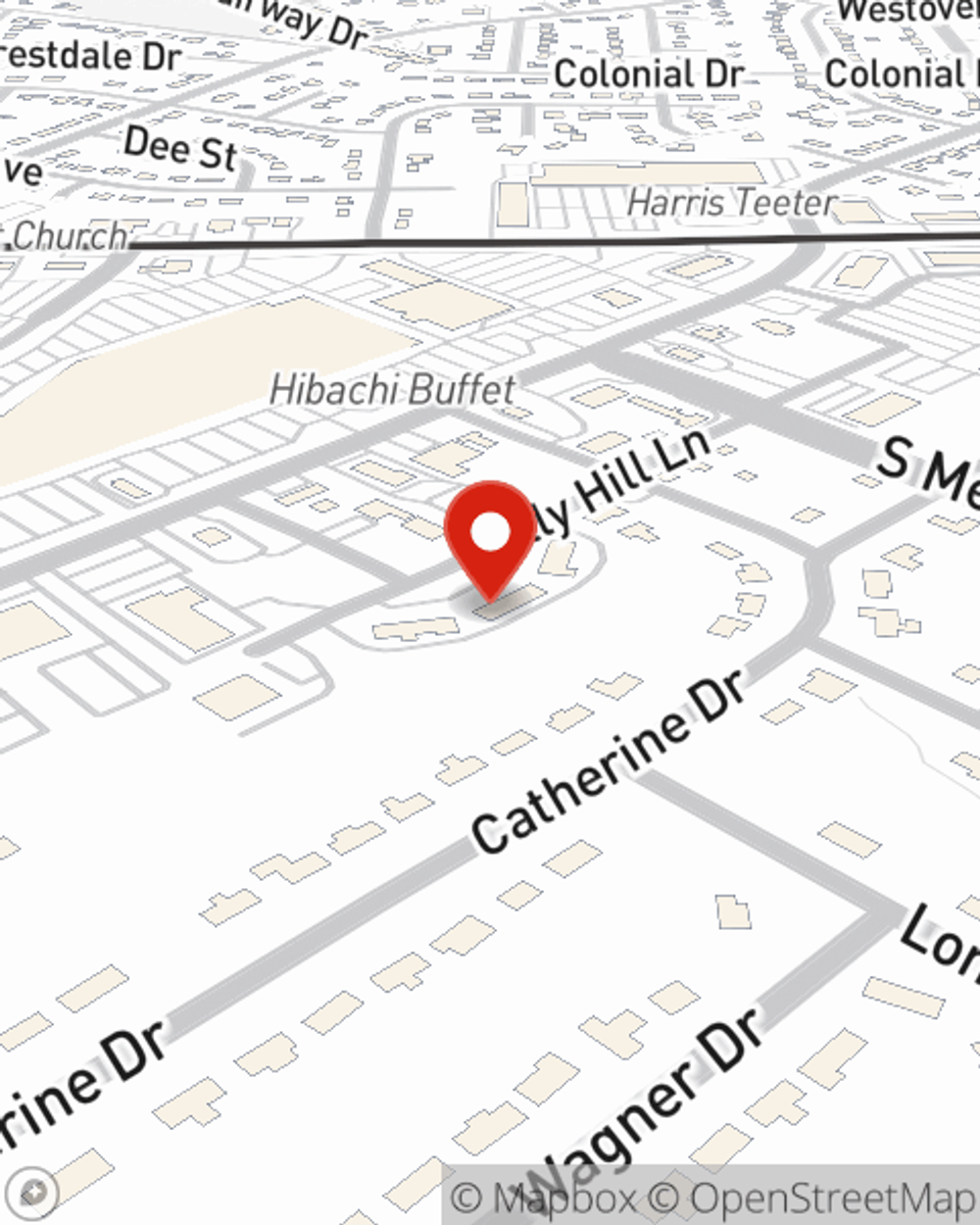

Condo Insurance in and around Burlington

Looking for outstanding condo unitowners insurance in Burlington?

Insure your condo with State Farm today

Calling All Condo Unitowners!

The life you cherish is rooted in the condo you call home. Your condo is where you catch your breath, chill out and slow down. It’s where you build a life with your favorite people.

Looking for outstanding condo unitowners insurance in Burlington?

Insure your condo with State Farm today

State Farm Can Insure Your Condominium, Too

You want to protect that unique place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as weight of ice or snow, hail or freezing of a plumbing system. Agent John Fitell can help you figure out how much of this fantastic coverage you need and create a policy that has what you need.

Don’t let the unexpected about your condo make you unsettled! Contact State Farm Agent John Fitell today and learn more about how you can benefit from State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call John at (336) 584-8686 or visit our FAQ page.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

John Fitell

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.